Young people, minorities among those reporting the biggest losses

Leer en español

The promise of hefty returns is what initially drew Jeffrey Vaulx, a second-grade special ed teacher in Memphis, Tennessee to go in on a cryptocurrency investment opportunity introduced to him by a Facebook friend.

Vaulx would soon discover that he had been taken by a scheme that data from the Federal Trade Commission (FTC) shows is part of a billion-dollar industry in the United States.

Vaulx set up an account on a website that he says, “looked legitimate.” He then transferred $500 cash to his friend, who was supposed to purchase the cryptocurrency – a form of unregulated digital money where transactions are verified through digital ledgers. His investment quickly grew to $8000, though to access that newfound wealth Vaulx learned that he would have to pay an additional fee of $500.

That’s when he says the red flags began to appear. “I went back to my friend’s website and saw it was all a hoax,” he recalled. “Fraud was in the back of my head.”

Vaulx was among a panel of speakers during a September 9 media briefing organized by Ethnic Media Services and the FTC.

Experts at the FTC stress that most cryptocurrency scams start with an unsolicited message, either through text, email, or social media. “Social media and crypto is a very combustible combination,” said Cristina Miranda, consumer education specialist at the FTC Bureau of Consumer Protection.

“Just know that a lot of these scams start off with tips or secrets on online message boards,” Miranda added. “There’s not going to be a whole lot of detail about what you’re investing in, because scammers are always trying to get you to be emotionally invested.”

According to the FTC’s Consumer Sentinel Network, an online resource for tracking scams, from January 2021 through June 2022 cryptocurrency scams have cost consumers over $1.3 billion. Nearly half of those victimized say the scam began with an ad, post, or message on social media.

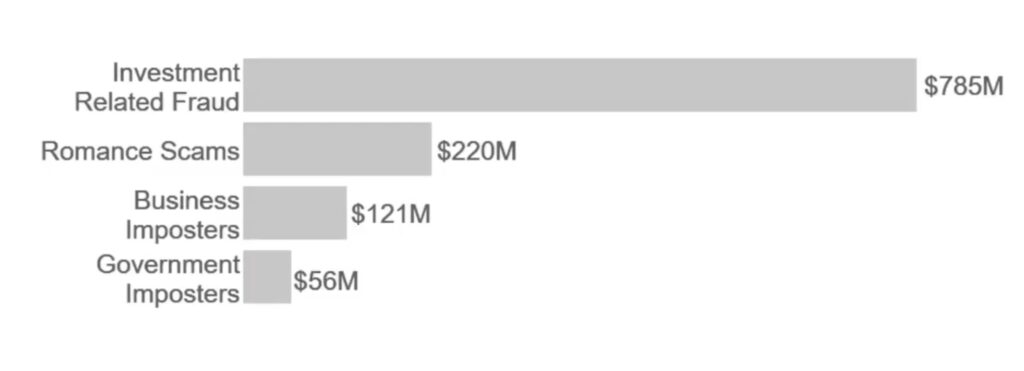

The largest share of the losses, about $785 million, involved bogus investment opportunities, followed by romance scams at $220 million, business imposters at $121 million, and government imposters at $56 million.

Miranda explained that romance scams or online dating scams involve charming the intended target before offering help with cryptocurrency investing. That’s when the request for money typically comes in.

In the case of fraudulent business scams, victims will often receive unexpected texts or security alerts popping up on their screens claiming to be from well-known companies like Amazon or Microsoft.

“If you click on any link, you will be connected to a scammer who tells you about fraud on your (cryptocurrency) account and that your money is at risk,” said Miranda.

Other scams attempt to impersonate government agencies, warning potential victims that their accounts or benefits will be frozen as part of some investigation.

Young people aged 18-35 and minority populations are among the groups that have reported the highest losses. These groups, Miranda explained, typically exist “outside the traditional financial ecosystem, they typically are unbanked and most open to using these emerging payment technologies.”

The unregulated nature of cryptocurrency — which exists outside traditional financial systems — has made it both more attractive to smalltime investors and opened the door to a ballooning scam industry.

And because transactions happen digitally, with no middleman involved, getting money back for victims has proven to be difficult, said Elizabeth Kwok, assistant director of litigation technology and analysis for the FTC’s Bureau of Consumer Protection.

Kwok added that because cryptocurrency is not backed by any government there is significant volatility in the market. “There is nobody overlooking the system… If there’s a run on a particular exchange, no entity is going to step in and make sure that consumers can get their money back.”

Since 2021, Bitcoin — the largest cryptocurrency by valuation — has fallen from a high of $60,000 per coin to as low as $22,000. The entire crypto market has dropped from a valuation of over $3 trillion to just over $1 trillion today.

Kwok noted the Biden administration is working to impose some regulation over the crypto market. “They are aiming for a more coordinated regulatory environment,” she said, pointing to an executive order from the president in March that directs federal agencies to implement policies and regulations for assets including cryptocurrencies.

The IRS currently taxes crypto assets as physical property like a car, and if they are used as an investment, the Securities and Exchange Commission gets involved, Kwok said.

“Education is really the first line of defense when it comes to avoiding problems in the marketplace,” said Rosario Mendez, senior attorney with the FTC Division of Consumer and Business Education.

As part of that effort Mendez urged people to come forward and report scams in their communities. “It’s really important,” she said, “so we can do something about it and alert others about these problems.”

“There are real people out there being hurt by this,” Mendez concluded.

Where to Report Scams

Victims can report scams directly to the FTC through its website in English and Spanish, as well as through the website of the regulatory agency Commodity Futures Trading Commission and the US Securities and Exchange Commission

More resources are available at ftc.gov/cryptocurrency and in Spanish at ftc.gov/criptomonedas.

If you or someone you know is the victim of a cryptocurrency scam, you should also report it to the cryptocurrency exchange involved. The FTC also recommends sending complaints to your state attorney general.