Payment methods that scammers insist you use — like gift cards, cryptocurrency and wire transfer — are telltale signs of scams, the Federal Trade Commission reported at a Sept. 22 Ethnic Media Services news briefing.

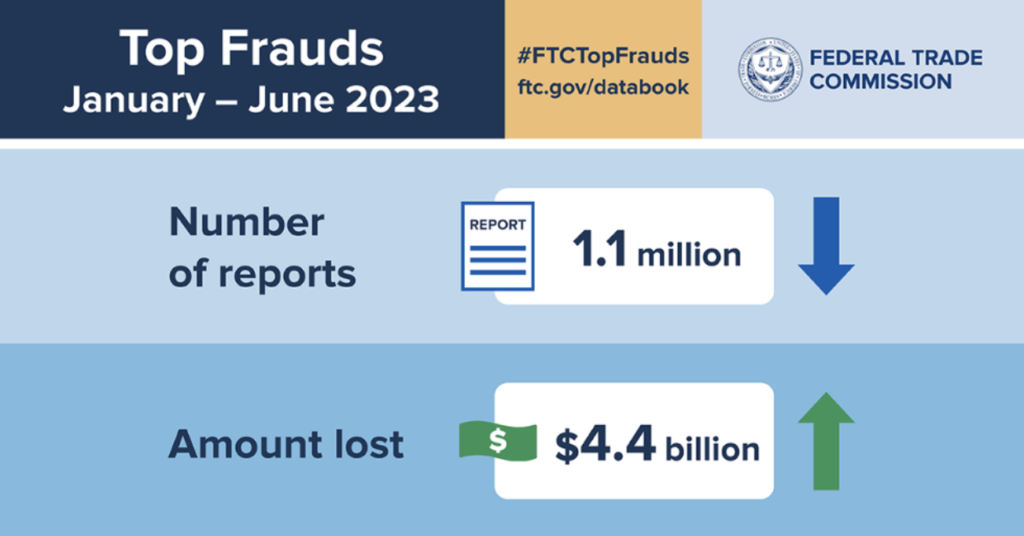

For the first six months of 2023, $4.4 billion dollars were lost across over 1.1 million reports of consumer fraud, per the FTC’s Consumer Sentinel Network — “and we know from our working experience, and from surveys, this is only the true tip of the iceberg,” said Lois Greisman, Associate Director of the FTC Division of Marketing Practices.

Forms of contact, payment

The primary point of contact that scammers use to reach people is social media, by which $658 million was reported lost in the first half of 2023. Phone calls have the highest per person reported losses, with a median loss of $1,400 per person.

“Just as scammers like certain forms of contact, like the telephone, which are most effective at getting someone to part with their money,” said Greisman, “they like certain types of payment because they can take the money with very little trail, while for the consumer it’s virtually impossible to get this money back.”

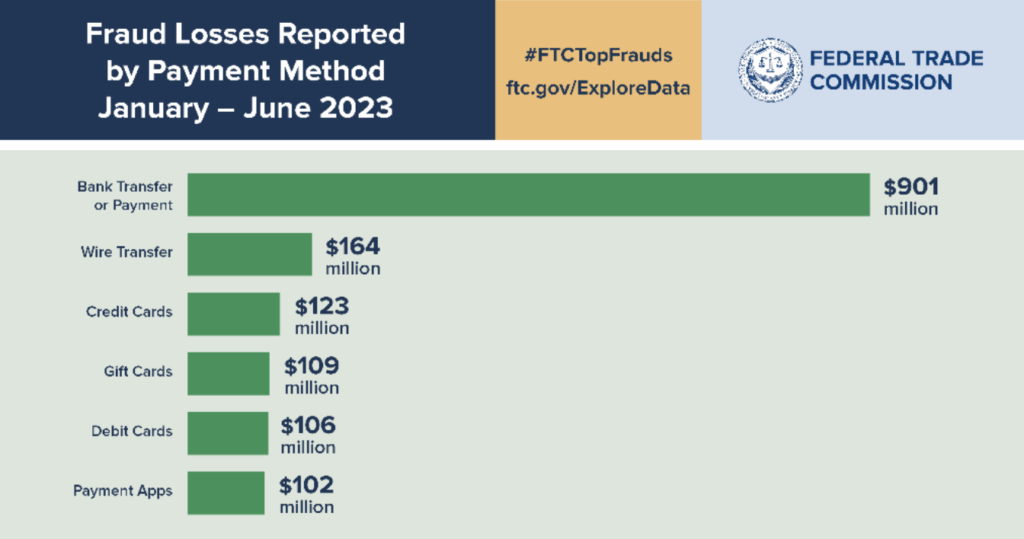

By far the greatest losses by payment method owe to bank transfers, for which $901 million was reported lost in the first six months of 2023 alone.

An example of this scam: “I get a call. I am told my grandson has been in a car accident, can’t find an insurance card, and needs surgery right away. The only way he can get it is if I go to my bank and I ask them to transfer $7,895 to an account in Canada,” Greisman said.

Other common payment methods include wire transfers, by which $164 million was lost in the first half of 2023; credit cards, by which $123 million was lost; gift cards, by which $109 million was lost; debit cards, amounting to $106 million; and payment apps like Zelle and Venmo, and Cash App, amounting to $102 million.

Much of these losses owe to imposter, lottery, investment, and business fraud — for example, “You get a phone call from the IRS that you owe back taxes, or from the sheriff’s office that there’s a warrant out for your arrest, or you’ve won the lottery and all you have to do is pay a processing fee” by sending or reading aloud the numbers of “a gift card for $100, or a few hundred,” Greisman said.

In the case of larger payments in the thousands and tens of thousands through cryptocurrency and wire transfers, “there may be an ‘expert’ online who wants to teach you how to get rich quick trading cryptocurrency, or becoming an entrepreneur by selling on eBay,” she added.

Sophia Siddiqui, an attorney for the FTC Division of Marketing Practices, said that due to low regulations, cryptocurrency has been on the rise over recent years as “the payment method preferred by scammers. Through online trading groups or social media, they’ll say they’re making millions in cryptocurrency, and that they’re offering investment advice for a limited time for an upfront $10,000 fee. You pay using their link, they put that money in their crypto wallet, and never contact you again.”

Never send money “to someone you don’t know or trust, who pressures you to pay immediately, or says that a certain payment method like a wire, gift card, or crypto is the only way to pay,” said Siddiqui.

Owing to low regulations and small paper trails, it’s very unlikely that money lost to cryptocurrency and wire scams, and gift cards can be recovered. Conversely, credit cards offer the best protections under federal law.

Stopping scams

“If you call your bank and say you didn’t authorize a charge on your credit card, they have to investigate, and you shouldn’t be liable for more than $50 — many banks won’t even charge you that,” said Siddiqui.

Likewise, for a gift card like Amazon, or a wire transfer like Western Union, “contact the company and ask them to reverse the charge. If you send cash or a gift card in the mail, ask USPS to intercept the package. If you give a scammer your social security number, go to identitytheft.gov to see what steps to take, like monitoring your credit,” she continued. “If you give a scammer access to your phone or computer, update your security software, run a scan, and delete anything problematic.”

Those facing a scam can report it at reportfraud.ftc.gov, and find information on how to avoid scams in various languages including Arabic, Chinese, Hmong, Korean, Spanish, Russian, Tagalog and Vietnamese at ftc.gov/languages.

Red flags

The best weapon in the fight against scams is, by far, education, Greisman and Siddiqui agreed.

Never underestimate how persuasive a scammer can be,” said Greisman. “What most helps is informing people about red flags. The bottom line is that how they want you to pay is the red flag. If you get a call or message asking with threats or promising returns for a gift card, a wire transfer, crypto — hang up, delete it, go offline, do whatever you need to do to stop contact. That’s not how a government entity or other institution would reach you.”

Likewise, Siddiqui added, it boils down to this: “Only a scammer will guarantee that you will make a lot of money with no risk.”